Amount is limited to 10 of aggregate income Subsection 4411B 4. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body.

Donate Royal Botanical Gardens

With its expertise in traditional medicine the institute has been assigned to support hospitals in 24 localities in the south and the Central Highlands.

. And you must keep the receipt of the donation. Pursuant to the Finance Act 2019 Section 44 6 of the ITA was amended to increase the cap on tax deduction for taxpayers other than companies from 7 to 10 of the aggregate income. Gift of money to Approved Institutions or Organisations.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for. Have given humble charities including envi. Amount is limited to 7 of aggregate income Subsection 44 6 3.

GCP accreditation from the Ministry of Health at the event. Since its inception PASS. For Daily Necessities Food Monetary Help For Bills etc 1.

Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under paragraph 13 Schedule 6 Income Tax Act 1967. Increase in deduction limit for donations. During the pandemic period the safety of students in higher education institutions was important and this was guided by the advice and direction of the national for the higher.

A approved research companyinstitute which. This campaign takes into account struggling families whose head of household has suffered pay cuts. In malaysia the government offers tax deductibles to help support the great.

Gift of money to Approved Institutions or Organisations. Should an approved institution or organisation or fund reapply for the purpose of contribution donation for COVID-19. Love Your Neighbor Penang.

A a training programme approved by malaysian. Amount is limited to 10 of aggregate income Subsection 446 3. Subsection 44 6 2.

52021 Date of Publication. Donations by cheque payable to pertubuhan kebajikan agathians malaysia or bank transfer to maybank account 1141 6096 5371. Heres quick scenario to briefly illustrate how the whole thing works.

Channel your donations to Malaysian Relief Agency Foundation CIMB Bank. Floods or through their website. An institution or organisation or fund that has been approved under subsection 446 of the ITA 1967 is eligible for.

30 SEPTEMBER 2021 Published by Inland Revenue Board of Malaysia Fourth edition Third edition on 9 October 2020 Second edition on 13 September 2018. Gift of money to the Government State Government or Local Authorities. The National Foundation for Communal Harmony.

HCM City Traditional Medicine Institute wins Labour Order award. Business registration No. Approved university or educational institution of national eminence.

Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. List of approved institution for donation in malaysia. Institution or organisation or fund approved under subsection 446 of the ITA 1967.

The public is also urged to check the background of organisations before making. Gift of money made to any approved institution organization or fund approved by the DGIR is also allowed as a deduction but restricted to 7 of the aggregate income of an individual. INLAND REVENUE BOARD OF MALAYSIA TAXATION OF A RESIDENT INDIVIDUAL PART I - GIFTS OR CONTRIBUTIONS AND ALLOWABLE DEDUCTIONS Public Ruling No.

Ahmad has an aggregate income of RM60000 and makes a donation of RM5000 to an approved institution in March 2021. Based on the revised guidelines the donor is required to provide complete information of the details stipulated below in order to obtain an official receipt or tax-exemption receipt from the approved institution or organization. For cash donations to institutions or organisations approved under subsection 44 6 the required documents are official receipts of.

Pertubuhan Amal Seri Sinar Kuala Lumpur Selangor PASS is a self supporting NGO formed in year 2003 with the aims to educate the public of recycling for charity. The new Guidelines have been amended to take into account the above change. To receive the receipt in accordance with lhdn malaysia regulations.

The MRA is a humanitarian organisation in Malaysia with a primary objective of assisting those affected by natural disasters or armed conflicts both local and abroad. Here is the list of contributions under donations gifts. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of.

Caremongering Malaysia Community Response To Covid-19 3. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. TYPES OF INSTITUTIONS OR ORGANISATIONS ELIGIBLE TO APPLY FOR APPROVAL UNDER SUBSECTION 446 OF THE ITA 1967 An institution or.

With effect from the YA 2020 the restriction on that allowable deduction is increased to 10 of the aggregate income of an individual. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government.

Supplies 4 Students United Way Oxford

United States High Resolution Bitcoin Concept Ad Ad High States United Concept The Unit Spiritual Warfare Bitcoin

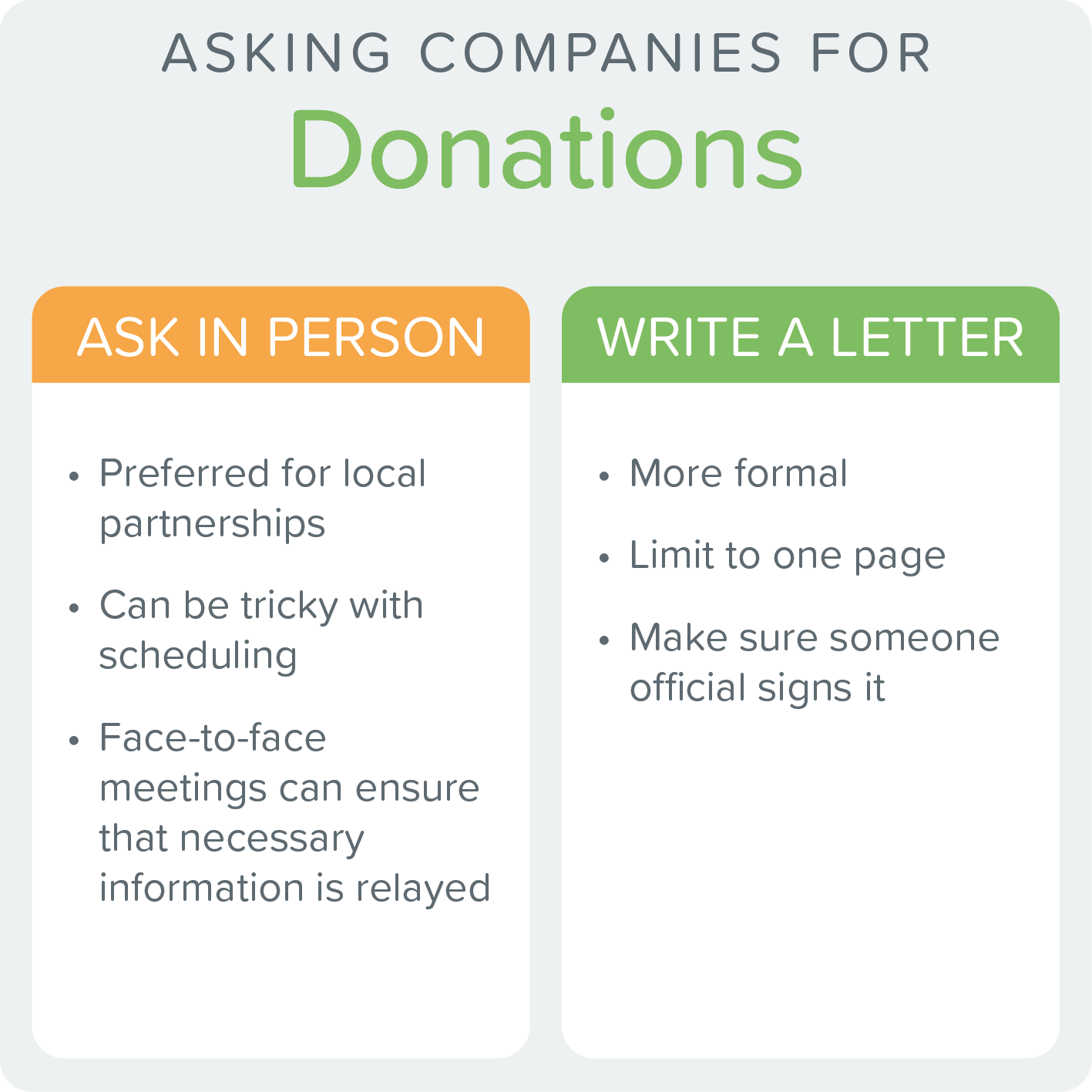

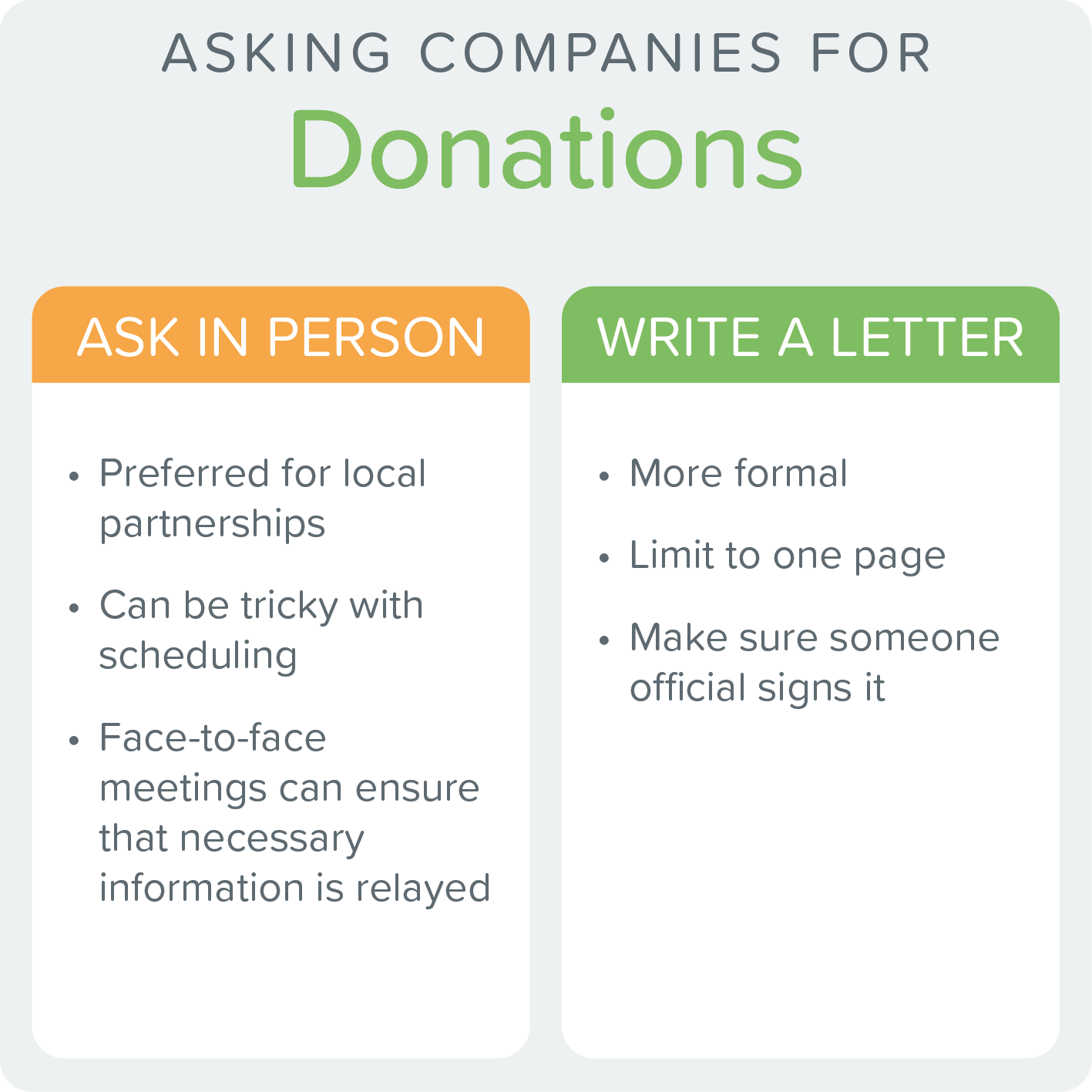

Asking For Donations From Companies

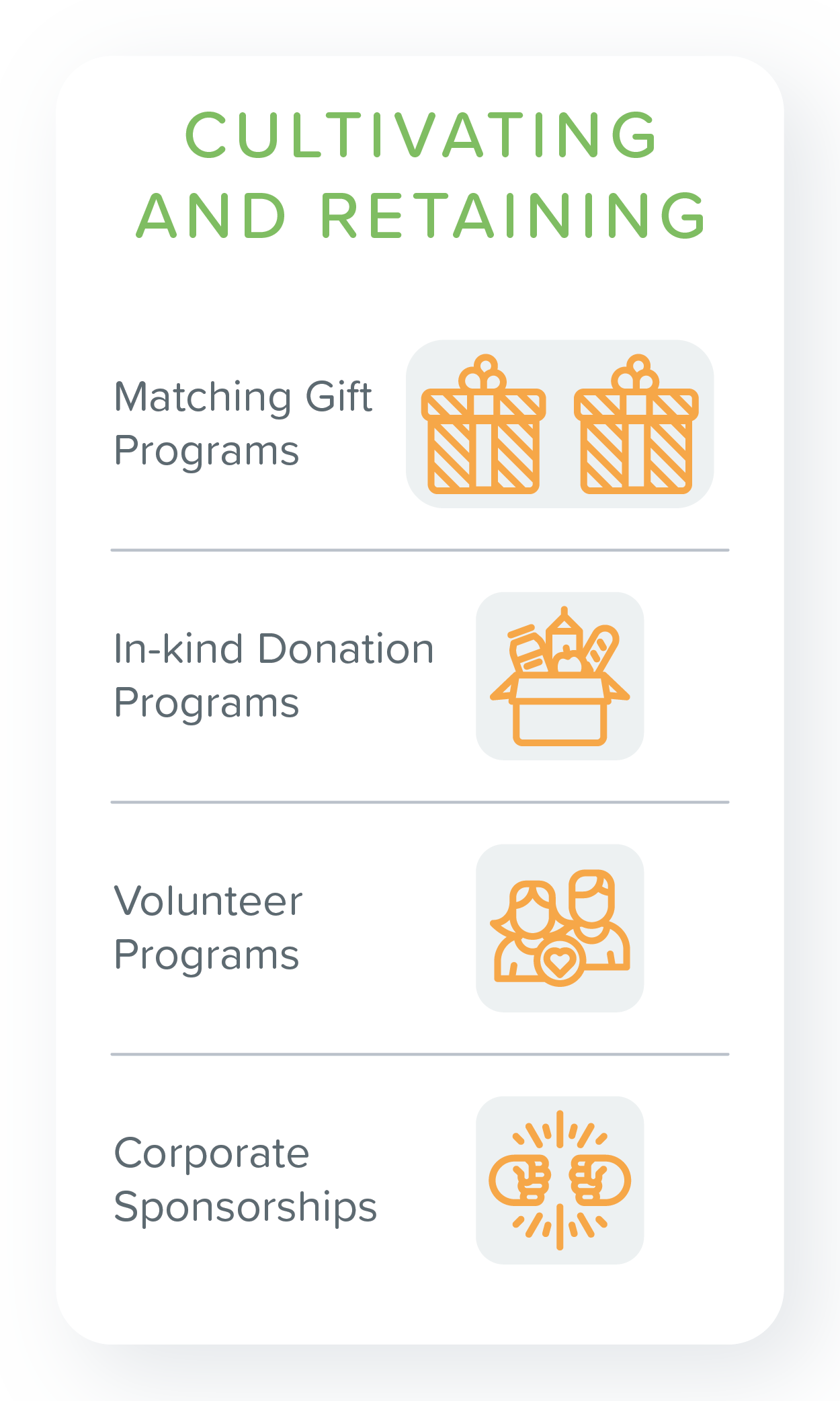

Six Effective Strategies To Encourage Corporate Donations

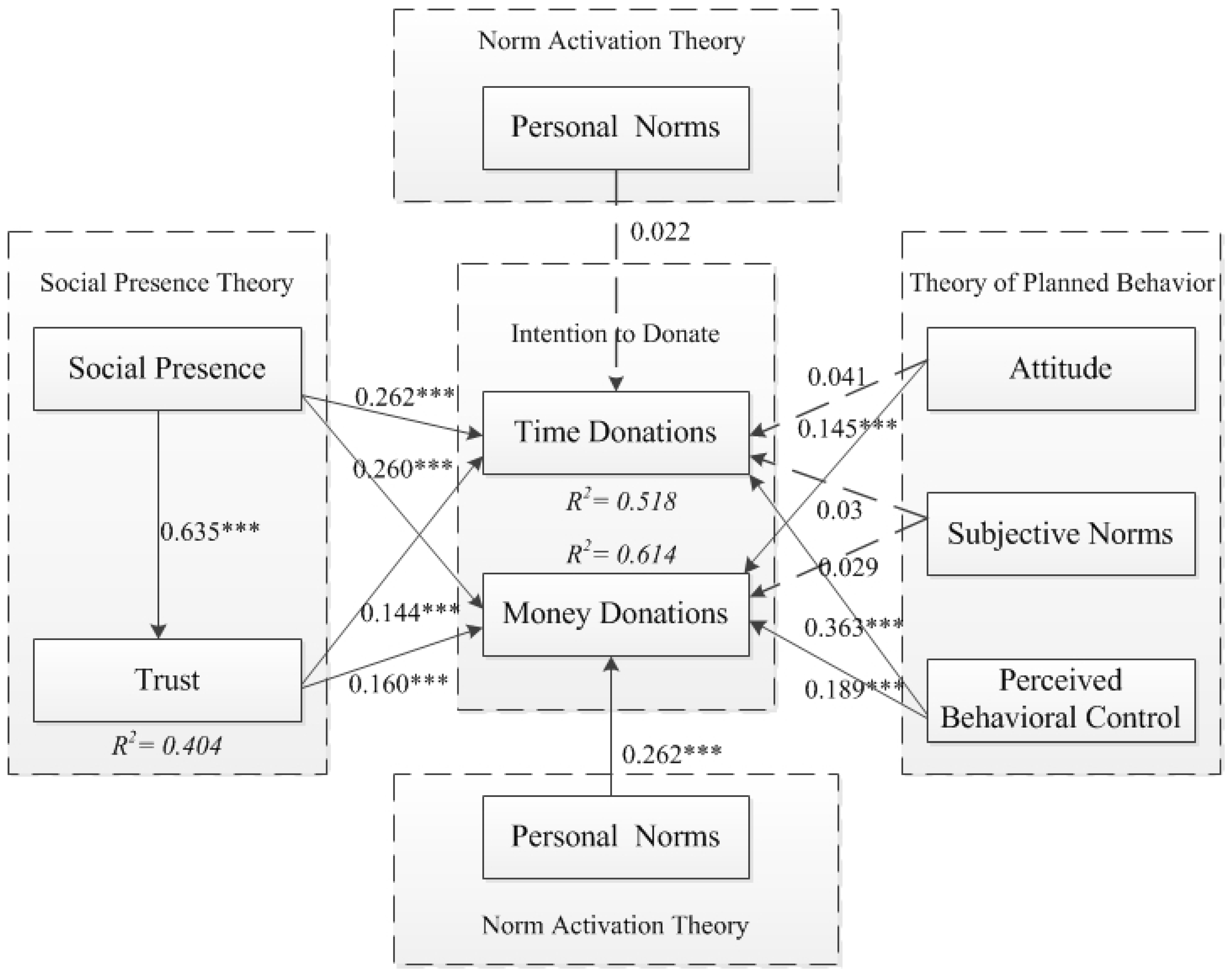

Sustainability Free Full Text Donate Time Or Money The Determinants Of Donation Intention In Online Crowdfunding Html

Business Letter Writing Sample Business Forms Business Letter Guide

Individual Income Tax Policy On Charitable Donations Kpmg China

How To Donate Bitcoin To Charity

9 Positive Effects Of Donating Money To Charity The Life You Can Save

Updated Guide On Donations And Gifts Tax Deductions

Organ Donation Campagin Poster College Project

Asking For Donations From Companies

Sustainability Free Full Text Donate Time Or Money The Determinants Of Donation Intention In Online Crowdfunding Html

Asking For Donations From Companies

Intention To Voluntary Blood Donation Among Private Higher Education Students Jimma Town Oromia Ethiopia Application Of The Theory Of Planned Behaviour Plos One

Harvard Received 1 4 Billion In Donations Last Year Infographic